Interest Rates Set to Fall: What This Means for Homebuyers?

Good news is on the horizon for prospective homebuyers and the broader economy. According to Deloitte’s recent report, Canada’s economic growth is expected to continue moderately in the coming year, and more importantly, interest rates are forecasted to drop below 3% by 2025. This marks a significant shift, particularly for those who have been waiting […]

Navigating Mortgage Foreclosures: Hope on the Horizon for Homebuyers

Navigating Mortgage Foreclosures: Hope on the Horizon for Homebuyers The recent spike in power-of-sale listings due to rising interest rates has left many homeowners in difficult financial positions. According to a recent report, mortgage lenders have been forced to repossess homes from over-leveraged homeowners who can no longer meet their payments, resulting in a doubling […]

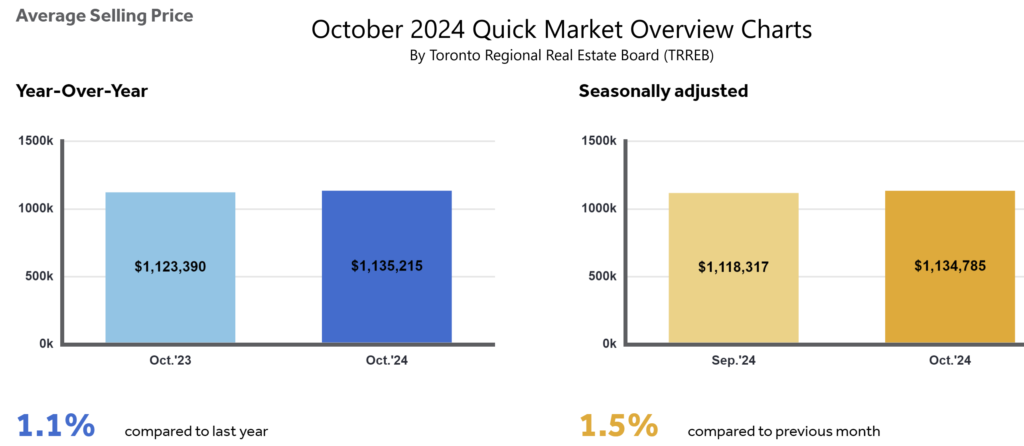

October 2024 Market Report

October 2024 Market Report: GTA Real Estate Trends The Toronto Regional Real Estate Board (TRREB) recently reported a notable increase in home sales across the Greater Toronto Area (GTA) for October 2024. This growth marks a 44.4% increase in sales from October 2023, reaching a total of 6,658 transactions. The boost in market activity is […]

You could be richer by $1,421…

Ontario Trillium Benefit (OTB) Payments: What to Expect The Ontario Trillium Benefit (OTB) offers essential financial support to low- and middle-income Ontarians through monthly payments, with the next scheduled for Friday, November 8. Here’s a complete breakdown: What is the OTB? The OTB combines three provincial credits: Who is Eligible? To qualify, residents must be […]

Toronto to extend down payment assistance to higher-income earners

Toronto to extend down payment assistance to higher-income earners Toronto’s recent proposal to extend down payment assistance to higher-income earners has sparked significant discussion. This initiative aims to support households earning between $125,000 and $150,000 annually—those in the 80th income percentile—who, despite their earnings, find it challenging to enter the city’s competitive housing market. Ontario […]

Bank of Canada’s Latest Rate Cut: How It Benefits Homebuyers and Mortgage Holders

Bank of Canada’s Latest Rate Cut: How It Benefits Homebuyers and Mortgage Holders The Bank of Canada made headlines today with an unexpected, extra-large interest rate cut, slashing the rate to 3.25%. This bold move signals a shift in economic policy, aiming to stimulate the economy and provide relief amid global uncertainties. This decision could […]

Bank of Canada Expected to Cut Interest Rates by 50 Basis Points: A Win or a Worry?

Bank of Canada Expected to Cut Interest Rates by 50 Basis Points: A Win or a Worry? The Bank of Canada (BoC) is making headlines this week, as it is widely expected to announce a 50-basis-point cut in interest rates during its upcoming meeting on Wednesday. While such a move may bring relief to borrowers and stimulate […]

Toronto-Area Home Sales Surge 40% in November: A Market Rebound in Line with My Vision

Toronto-Area Home Sales Surge 40% in November: A Market Rebound in Line with My Vision The latest Toronto Regional Real Estate Board (TRREB) report has revealed a sharp rebound in the housing market. November 2024 saw a 40% year-over-year increase in home sales, with prices also starting to edge upward—a clear sign of renewed buyer confidence […]

Following Up: Toronto Explores Down Payment Support for Middle- and Higher-Income Buyers

Following Up: Toronto Explores Down Payment Support for Middle- and Higher-Income Buyers In a follow-up to my previous blog on housing affordability challenges and innovative solutions, here’s the latest development that could reshape the landscape of homeownership in Toronto. Toronto is exploring a groundbreaking proposal to extend down payment assistance to higher-earning residents. Traditionally, homebuyer […]

Canada’s Economy: A Modest 1% Growth and What It Means for Interest Rates and Homebuyers

Canada’s Economy: A Modest 1% Growth and What It Means for Interest Rates and Homebuyers In the latest economic update, Canada’s GDP showed a modest 1% growth in the third quarter of 2024, falling short of the Bank of Canada’s (BoC) forecast of 1.5%. While this figure may seem minor, it carries significant implications for […]